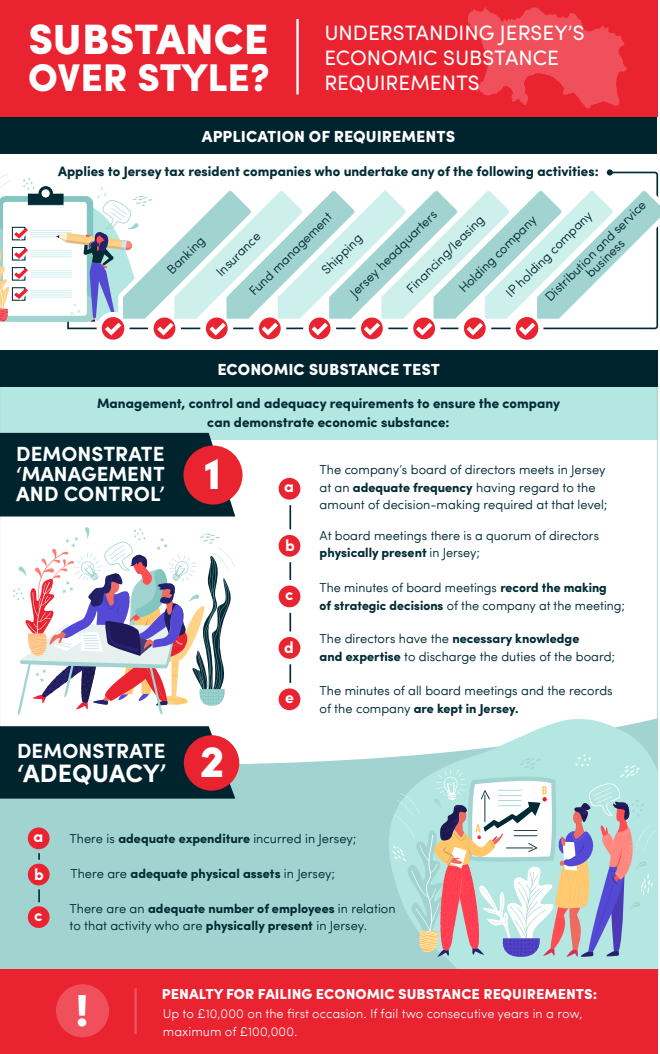

Substance over Style?

Understanding Jersey’s Economic Substance Requirements.

Effective from January 2019, the Crown Dependencies of Jersey, Guernsey and the Isle of Man, will have new tax legislation in place to ensure that tax resident companies of each of those jurisdictions have a real operational presence or ‘substance’ in the relevant jurisdiction. If a Jersey tax resident company is undertaking any of the following activities or is headquartered in Jersey, then it needs to do an urgent audit of how it measures against the economic substance requirements:

- Banking

- Insurance

- Fund Management

- Shipping

- Financing/Leasing

- Holding Company

- Intellectual Property

- Distribution and service business

Failure to meet the economic substance requirements will result in a penalty of up to £10,000 on the first occasion. Failure to comply two consecutive years in a row could result in a penalty of up to £100,000 or your company being struck off the Companies Register.

To understand if your business or company will need to adhere to the new economic substance requirements, take a look at our one-page Infographic:

Click here to view the detailed guidance issued jointly by the Crown Dependencies on 26 April 2019.